Actance Tribune

What's NEW under French Employment Law?

N° 34 – January 6, 2025

The impact of illness on the employee’s right to receive bonuses

Employees may receive, in addition to their fixed salary, supplementary compensation in the form of a performance or output bonus linked, in particular, to the employee’s own activity or the activity of their team, for example.

The question regularly arises as to whether the employee, absent for part of the year for medical reasons, is entitled to request the benefit of these bonuses. To find out, it is necessary to refer to the provisions that established them, whether they come from a collective agreement, the employment contract, or even from practices (“usages”).

However, a difficulty arises when the text establishing the bonus does not provide for the case of an employee whose employment contract is suspended. It is to this difficulty that the French Supreme Court attempted to respond in a ruling on November 20, 2024, regarding a performance bonus (Cass. Soc., November 20, 2024 No. 23.19.352).

An employee, absent for medical reasons for three years, had requested in court the payment of back payments of bonuses based on objectives. This bonus, which was not contractually provided for, was paid semi-annually based on objectives set by the employer.

The Court of Appeal granted her request after noting that, in the absence of specifics on the determination of this bonus, particularly in the case of suspension of employment contract, the employee, who had not been given any objectives at the beginning of the period, could claim an amount calculated by reference to the maximum amount of the bonus previously received.

The French Supreme Court overturned the judges’ decision and recalled the principle that, in the presence of a bonus intended to remunerate or reward activity, an employee whose employment contract is suspended does not have the right to benefit from this bonus, as no work has actually been performed. The Supreme Court concludes that in the absence of a guaranteed salary clause, the employer could therefore deprive the employee of this bonus.

The solution would probably have been different in the presence of a bonus unrelated to the employee’s activity, for example, in the hypothesis of a bonus linked to the activity of the team to which the employee belongs.

It is therefore strongly advised, as soon as the bonus results from a text other than the collective agreement, to clearly define the conditions for obtaining it, especially in the case of suspension of the employment contract.

Should an accident occurring during remote work be treated as a domestic accident or an occupational accident?

The accident suffered by the employee while teleworking raises uncertainties: did the accident occur under the conditions indicated by the employee? did it truly happen during working hours or in a place authorized by the employer? what is the value of the testimonies provided by the employee when they come from the spouse present at the time of the accident? More generally, how can the exact conditions of the accident be assessed when the employer had very limited control over the organization and working hours of their employee?

The question is not without importance in view of the consequences that the qualification of the accident entails, in terms of the protections granted to the employee (protection against dismissal, doubled severances, compensation by social security, more favorable, etc.) and consequences for the employer (action for recognition of inexcusable misconduct, variation of the occupational accident / occupational disease’ contribution rate).

By establishing a presumption of work-relatedness, the legislator intends to facilitate the qualification of an occupational accident occurring during telework (I) but this presumption is counterbalanced by a meticulous examination, by the trial judges, of the conditions under which the accident occurred (ii).

(i) A facilitated recognition of the occupational nature of the accident of the employee in telework …

Article L 411-1 of the Social Security Code has established a presumption of work-relatedness for accidents occurring during working hours and at the workplace which applies to teleworkers as well.

This presumption exempts the teleworker from proving the causal link between the accident and the professional activity as long as the accident occurs during the activity: it is therefore up to the employer who disputes it to establish that the accident occurred outside working hours or any professional activity.

(ii) … but counterbalanced by a meticulous assessment of the facts by the trial judges

The trial judges conduct a thorough examination of the circumstances of the accident.

They will thus set aside the presumption if :

- The accident did not occur at the teleworking location

- the employee was injured by the fall of a telephone pole when he had left his home, after hearing a crash following which the internet connection of his home was interrupted. (CA Saint-Denis de la Réunion, 4 May 2023, No. 22/00884)

- the employee was injured by the fall of a telephone pole when he had left his home, after hearing a crash following which the internet connection of his home was interrupted. (CA Saint-Denis de la Réunion, 4 May 2023, No. 22/00884)

- The accident occurred outside of teleworking hours

- the employee had fallen on the stairs of her home one minute after the end of her teleworking day (which was established thanks to the badge system implemented by the employer) (CA Amiens 15 June 2023, No. 22/00474).

- the accident occurred after the employee’s lunch break as the employee did not established having reconnected or performed any task under the authority of the employer after her lunch break(CA Rouen, 26 April 2024, No. 23/00840).

In both of these cases, the judges were able to note that the employee was no longer under the authority, supervision, or control of their employer.

In light of the employer’s limited ability to monitor the activity and hours of a teleworking employee, it is therefore recommended, when the company uses telework:

- to adopt a precise wording of the telework charter or collective bargaining agreement to frame these situations (e.g., clearly defining the telework location, providing time slots for availability for employees on a daily telework schedule, etc.);

- to implement a system for tracking the professional activity of the employee and a time recording device via computer authentication;

- in case of an accident, to issue reservations about the occupational accident declaration as soon as the employer considers the materiality or working hours of the accident to be contestable.

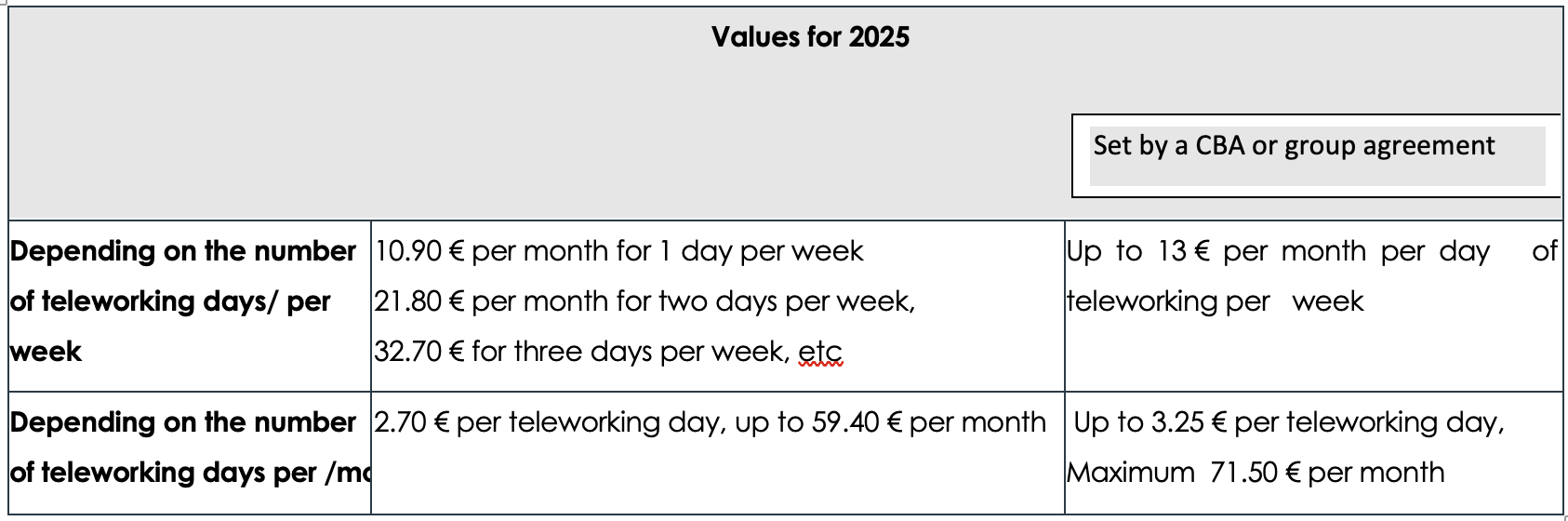

Teleworking expenses for 2025

The reimbursement of professional expenses incurred due to teleworking can either be paid based on their actual value or a flat-rate allowance. Considered to be used in accordance with its purpose, it is exempted from social security contributions and taxes within the limits detailed in the table below.