Actance Tribune

What's NEW under French Employment Law?

N° 26 – April 8, 2024

Illness of an employee during a disciplinary proceeding during a work stoppage: obligation for the employer to report an occupational accident

The Court of Cassation has specified that the illness of an employee occurring during a disciplinary proceeding must be the subject of a declaration of an occupational accident by their employer, regardless of whether the employment contract of this employee is suspended at the time of the incident (Court of Cassation – social division, February 14, 2024, no. 22-18.798).

In this case, an employee, who had been off work for 3 months, was summoned to an interview prior to possible dismissal before a joint advisory committee. During her appearance, she felt unwell.

She was then dismissed but then appealed to the Labour Court in order to have her dismissal declared void and to order the company to report her occupational accident.

The court of appeal rejected the employee’s request on the grounds that, while her illness arose during her interview; her employment contract was suspended on that date and her work was not the cause. Consequently, this was not be covered by the legislation relating to occupational accidents.

The Court of Cassation overturned the appeal decision on the basis of Articles L. 411-1 and L. 441-2 of the Social Security Code, recalling that:

- “an occupational accident, whatever the cause, is the accident occurring as a result of or in the course of work to any person employed or working, in any capacity or in any place whatsoever, for any or several employers or business managers”;

- “the employer or any of their employees must declare any accident of which they are aware to the primary health insurance fund (CPAM) to which the victim belongs pursuant to the terms and conditions and within a specified period.”

The court also noted that the employee was appearing before a body called to rule on a disciplinary sanction against her when she felt unwell. It deduced that notwithstanding the suspension of her employment contract, this employee was under the dependence and authority of her employer, who was then required to declare this accident to the competent primary health insurance fund (CPAM), regardless of their opinion on the causes of the accident.

Note: When an employee is the victim of a (non-fatal) occupational accident, the employer must obligatorily declare the accident to the primary health insurance fund (CPAM) to which the victim belongs (social security code art. L. 441-2) by any means recording a specific date of receipt (registered letter with acknowledgment of receipt or on the e-DAT service of the net-entreprises.fr portal), within 48 hours not including Sundays and holidays (social security code, R. 441-3).

Any accident occurring at the time and place of work is presumed to be a work accident, unless it is established that the cause of the injury is totally unrelated to work (Court of Cassation, Civil Chamber 2, July 11, 2019, no. 18-19.160 ).

The employer shall not be the judge of the professional nature of the accident. They must declare all accidents of which they are aware to the primary health insurance fund (CPAM), even if they are certain there is no link between the accident and work. Should there be doubts about the professional nature or material proof of the accident, the employer may formulate reservations within 10 clear days following the declaration (social security code art. R. 441-6). The declaration of these reservations by the employer requires the primary health insurance fund (CPAM) to investigate the matter in a contradictory manner and allows the employer access to the elements of the case. In practice, we advise employers to make reservations whenever reporting an accident.

Supplementary health insurance: an obligation for employers in France

In France, “supplementary health insurance” refers to an insurance contract, the aim of which is to supplement Social Security reimbursements in the fields of illness, accidents and maternity. These contracts allow all or part of related health costs to be covered.

Supplementary health contracts can be either individual contracts (concluded directly between an individual and an organisation) or collective contracts (concluded by an employer or a legal entity).

Whether individual or collective, they can be taken out with three types of organisations: mutual societies, insurance companies and pension institutions. Each of these types of organisation is subject to specific regulations and codes.

This type of insurance also exists in other countries such as Germany, Belgium, Luxembourg and Denmark.

Guarantees vary depending on the contracts offered by insurance institutions. Generally however, the contracts cover medical or surgical hospitalisation costs, surgical procedures and costs, the daily hospital rate, consultations and visits from general practitioners or specialists, pharmaceutical costs, etc.

- The obligation for employers to offer supplementary health insurance to their employees

Since January 1st, 2016, employers in the private sector have been required to finance, at least up to 50%, supplementary collective health insurance with compulsory membership for their employees (CSS, art. L.911-7).

The social security code nevertheless provides for exceptions allowing to request an exemption from compulsory membership in company supplementary health insurance, specifically:

- employees already covered by supplementary health insurance from another employer or as beneficiaries thereof;

- beneficiaries of supplementary solidarity health insurance;

- certain employees on fixed-term contracts and part-time apprentices.

These employees can choose not to join the insurance system offered by their employers.

- The establishment of compulsory supplementary health insurance

The establishment of a company supplementary health plan must be formalised by a legal act of labour law. This can be done through a collective agreement, a referendum or a unilateral decision by the employer.

Employers then take out a group insurance contract with the insurance company of their choice.

- Compliance with minimum guarantee coverage “Supplementary health” group insurance contracts with compulsory membership taken out for the benefit of a company’s employees must respect a minimum range of care.

Contracts concluded to ensure this minimum coverage must also comply with the specifications of so-called “responsible” contracts, defined by a decree specifying the upper and lower limits for reimbursement of care, as well as certain prohibitions in coverage

What the responsible contract covers

- co-payment: part of health expenses which remain the responsibility of the patient after reimbursement by the French social security

- the hospital daily rate

- prevention actions

- general practitioner and specialist consultations

- dental, optical and hearing care.

What the responsible contract does not cover

- flat rate contribution for medical procedures and consultations with a doctor or health establishment;

- the medical excess for medicines and paramedical procedures as well as medical transport;

- the increase in the insured person’s contribution when they consult a doctor outside the coordinated care pathway (the health insurance reimbursement rate then falls from 70% to 30%);

- excess fees beyond certain upper limits for doctors outside the coordinated care pathway (except consultation with gynaecologists, ophthalmologists, psychiatrists and oral surgeons.)

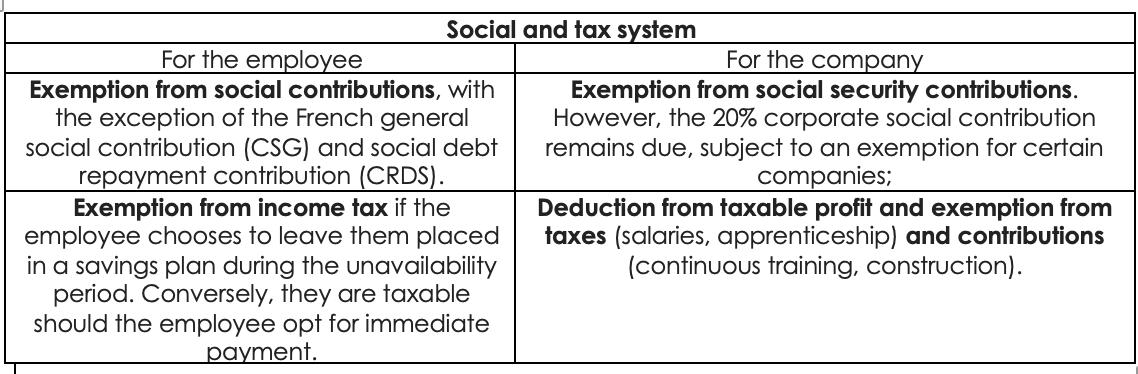

3. The benefit of social and tax advantages

Employer contributions to finance supplementary health coverage meeting the specifications of the responsible contract benefit from a preferential social and fiscal treatment, provided that the relevant scheme established in the company by a labour law act is collective with compulsory membership.

Consequently, and subject to the exemptions mentioned above, all employees holding an employment contract shall be covered, including those of employers who do not have an establishment in France.

4. Non-compliance by the employer with their obligation to set up supplementary health insurance

The social security code does not provide for any sanction should the employer failed to fulfil this obligation.

However, if there is no supplementary health insurance established by the employer, an employee having to assume health costs may request reimbursement by their employer, initially via the Labour Court.

Moreover, when compulsory and collective supplementary health insurance has not been set up using a collective agreement, a referendum or a unilateral decision by the employer, the company cannot benefit from the tax exemptions of social security contributions without risking an adjustment from the URSSAF.

Profit-sharing: an obligation for companies with at least 50 employees

In France, companies which, for 5 consecutive years, have at least 50 employees are required to share part of the profits they have made with their employees.

This system for redistributing company profits is called “Profit-sharing” and the sums distributed are known as the “special profit-sharing reserve” (RSP).

In principle, this system is set up in the company by agreement. This defines the rules for calculating, allocating and managing profit-sharing and may possibly provide for a seniority condition not exceeding 3 months. Should there be no implementation act, a legal scheme, known as authority, applies to the company. This scheme does not allow any adjustments and does not allow to benefit from social security contribution exemptions.

The minimum amount of sums distributed to employees is defined by the Labour Code which defines a calculation formula. Profit-sharing agreements may provide for a different calculation method, as long as the overall amount distributed is at least that resulting from the application of the legal formula.

Profit-sharing is allocated collectively and can be distributed either uniformly among employees, or proportionally according to salary, or to the duration of the employee’s presence during the financial year, or by a combination of these criteria. If there are no details in the profit-sharing agreement, the applicable rule is a distribution proportional to salary.

The profit-sharing agreement must be filed with the Administration. Failing a request for withdrawal or modifications within a 3-month period, the clauses of the agreement are deemed valid and the exemptions from social security contributions can no longer be challenged by the URSSAF.

The employee can request immediate payment of the sums or their investment in savings. In this case, the sums are unavailable for 5 years (8 years in the event of application of the authority scheme) if they are paid into a company savings plan, or until retirement if they are paid into a retirement savings plan. Cases of early release are permitted in certain situations (marriage/civil union, termination of contract, over-indebtedness, etc.).

To benefit from this favourable social and tax regime, the profit-sharing sums distributed cannot exceed an individual upper limit, per employee, that is 75% of this same annual upper limit and the salary taken into account for the profit-sharing distribution cannot be more than three times the annual Social Security limit.

Note: In France, companies with at least 50 employees are required to set up a profit-sharing scheme.

There are also other profit-sharing schemes (for example, incentive plans, value sharing, etc.) however, these are optional.

The common point among all these systems is the sharing with employees of the wealth generated by the company while applying a social and tax scheme for the sums paid that is more favourable than that applied to salaries and which varies depending on the system chosen.