Actance Tribune

What's NEW under French Employment Law?

N° 19 – September 18, 2023

Workforce reduction plan and the prevention of occupational stress risks

In France, any company with at least 50 employees that dismisses at least 10 employees for economic reasons over 30 days must establish what is called an “employment protection plan” (PSE in French), in order to limit the number of dismissals, and to encourage the redeployment of employees whose dismissal is inevitable.

This plan, established unilaterally by the employer or negotiated with the unions, is to be communicated to the Labour Administration for approval (or validation).

Among the consultations to be made in this context, the Labour Code requires employers to inform and consult the SEC on “the consequences of the reorganisation in terms of health, safety and working conditions” (art. L. 1233 -31 of the French Labour Code).

Most annulments of approval decisions by the courts now concern this subject: the level of requirements of the administration control, and therefore on the content of the documents drawn up by the company is very high.

Thus, in two judgments of March 21, 2023 (no. 450012 and no. 460660-460924), the French Council of State ruled that the Labour Administration must verify, as part of their control mission:

- that the CSE has been officially informed and consulted concerning the risks likely due to the company reorganisation, in particular occupational stress risks, and that the employer has communicated to the SEC the elements concerning the identification and assessment of these risks,

- That the employment protection plan contains measures to prevent these risks and so protect employees to ensure their safety as well as physical and mental health, throughout the planned reorganisation.

Otherwise, the employment protection plan cannot be approved by the Labour Administration.

Thus, approval of the employment protection plan depends on:

- the identification by the employer of risks to the health, safety and working conditions of employees due to the planned reorganisation project (specifically occupational stress risks),

- but also the existence of real preventive measures to protect employees.

Preventive actions must at least include:

- the establishment of a psychological crisis line with direct, unlimited and confidential access by telephone, 24 hours a day, via a toll-free number;

- the deployment of an employee communication campaign concerning occupational stress.

Also, the following are highly recommended:

- the organisation of training about occupational stress risks for managers;

- the use of an external service provider specialised in psychological support for employees during reorganisation periods.

Finally, it is very important that these actions target both employees whose dismissal is planned and employees retained (who could, for example, experience a transfer of workload and so adapt to a transformed work organisation).

Benefits of conciliation in court

Under French law, a dispute between an employer and employee is decided by a specific court, called the Conseil de prud’hommes (essentially the Labour Court).

This court has several distinguishing characteristics, including a compulsory prior conciliation phase.

During this phase, the parties are invited to attempt an agreement to end their dispute.

If there is an agreement, established by a report signed during the conciliation hearing, a so-called lump sum conciliation compensation is paid to the employee/former employee.

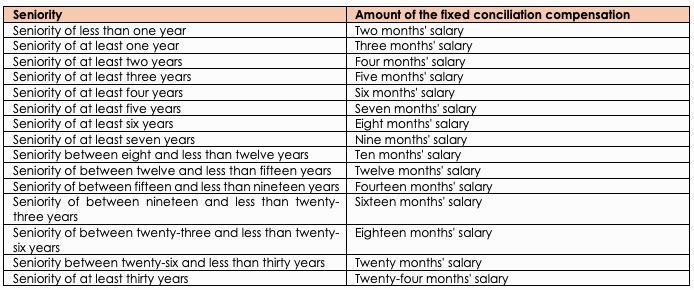

The amount of this compensation is defined by reference to a regulatory scale depending on the employee’s seniority:

The flat-rate conciliation compensation has two major advantages compared to a standard transactional compensation and can be a negotiation lever depending on each situation:

- It is fully exempt from income tax within the limits of the aforementioned scale.

In cases of significant seniority and a high salary, the portion of termination compensation exempt from income tax may be much greater than in the case of a standard transaction.

For example:

- more than 26 years of seniority

- average monthly salary of €20k gross,

- conventional severance pay already received to balance accounts: €100k.

- Should there be a payment of a lump sum conciliation compensation of €400,000 (20 months of salary corresponding to the scale), this conciliation compensation shall be entirely exempt from income tax.

- This situation can be compared to the standard transactional compensation: if there is a transaction outside the legal process, only €163,952 would have been exempt from income tax (more than €236,000 would thus be subject to income tax.

- It is not taken into account in the deferred compensation applicable to the employee before receiving unemployment benefits.

In France, employees do not immediately receive their unemployment benefits after leaving the company. Compensation is postponed to the end of a deferral period (known as a specific deferral) calculated according to the termination compensation in excess of that legally due, which is a maximum of 150 days.

In our example, if a lump sum conciliation compensation is paid, the employee will not have a specific Pôle emploi (employment centre) deferral, whereas if a transactional compensation is paid, the deferral would be 150 days, or 5 months.

Duration of work for autonomous employees: the flat-rate day system implies real independence in time management

In France, ideally an employee’s working time is counted in hours with a legal duration of 35 hours per week. For employees who are sufficiently autonomous in their schedule, it is possible to calculate working time based on the number of days worked over the year.

This scheme nevertheless must obey many legal constraints: specifically, it must be provided for by a collective agreement comprising various mandatory clauses, and then requires the express agreement of the employee concerned.

This system is increasingly challenged in court and there have been numerous decisions invalidating it.

In a judgment on June 7, 2023 (no. 22-10.196), the Court of Cassation recalls that the employee on a fixed-day basis must have real autonomy. Otherwise, the day flat-rate is not valid.

In this case, the employee was to clock in when entering the factory, for each half-day they were there, which created computer records showing their arrival and departure times as well as the number of hours worked each day. To be approved, a working day had to include six hours on-site at the company.

For the Court of Cassation, this meant that the employee did not have real autonomy in the organisation of their schedule and so was not subject to a fixed day flat-rate.

Consequently, the day flat-rate was invalid, and the employee is considered to have been subject to a standard hourly system: they can thus request payment of overtime for any hours worked beyond the legal duration of 35 hours per week.

In practice, it is often at the time of challenging their dismissal that the employee questions the validity of their day flat-rate and consequently requests payment for overtime. The limitation period is three years, the amounts involved can be – very – high, concerning the increases due to overtime, without taking into account many other financial implications (compulsory compensation for rest, related paid holiday allowances, possible lump sum compensation for hidden work, employer contributions, etc.).

In order to be able to demonstrate the employee’s independence, the employee on a fixed-day basis:

- must not be subject to a schedule,

- must be free to choose their working hours,

- cannot even be imposed a minimum number of working hours to fulfil a day of work (as was the case for the decision of June 7, 2023): a clocking obligation could possibly apply if it were designed to only count the days worked without counting hours.

That being said, the employee’s independence is not total; the employer can make constraints concerning the work organisation, for example:

- the definition of half-days or working days, when the employee works in an establishment receiving patients by appointment with a schedule defined in advance (Court of Cassation – social division, February 2, 2022 no. 20-15.744).

- the obligation to ensure the closure of a store or to be on call (Court of Cassation – social division, December 15, 2021 no. 19-18.226).

These constraints must be in the context of the work and the missions to be carried out, but cannot be hourly obligations: they must not affect the autonomy of the employee in their work. Otherwise, sanction is immediate.