Actance Tribune

What's NEW under French Employment Law?

N° 16 – May 11, 2023

Presumption of resignation in case of abandonment of post by the employee – Update

In our November publication, which you can find here, we announced that a bill was being discussed in Parliament to create a presumed resignation in case of abandonment of post by an employee.

The bill was adopted last December and a recent decree dated April 17, 2023 as well as a Q&A from the French Government provide some answers to issues that were unclear.

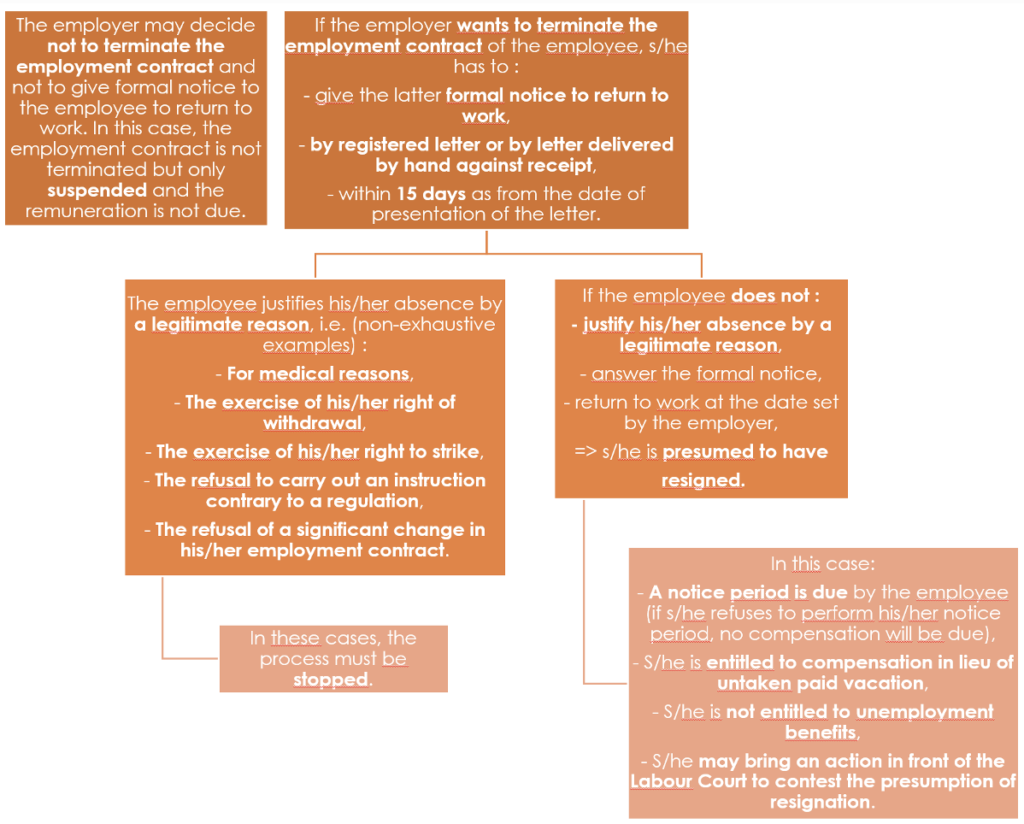

The French Labor Code now provides that an employee who has voluntarily abandoned his or her position and does not return to work after being given formal notice to do so is presumed to have resigned.

The steps of the process in case of abandonment of post by an employee are the following :

Several questions remain pending (while waiting for the first court decisions on this subject), in particular how judges will assess the legitimacy of the reason given by the employee to justify his/her absence, since the Labor Code does not provide a limitative list of situations considered as legitimate or not.

Pension reform in France – Update

In our February publication, which you can find here, we informed that a pension reform project was being discussed in Parliament.

The amended Social Security Financing Act for 2023, on pension reform, was finally promulgated by the President of the Republic and published on April 15, 2023, following the decision of the Constitutional Council which was expected before the law could come into force.

In its decision of April 14, 2023, the Constitutional Council has mainly validated the reform bill.

However, six provisions have been rejected, among which:

– the establishment of an index relating to the employment of aged employees in companies with at least 300 employees,

-and the creation of a specific end-of-career applicable to employees aged 60 or over.

It should be noted that the Constitutional Council censured these provisions on the sole ground that the Social Security Financing Act was not the appropriate tool for their implementation, stating that this censure does not « prejudge the conformity of their content with other constitutional requirements« .

It is therefore possible (actually likely) that all or part of these measures will be reintroduced in a further bill.

The other measures included in the bill (presented in our February publication) have been validated and will come into force as of September 1, 2023, among which is the progressive raising of the retirement age from 62 to 64 (the most unpopular measure of the reform, leading to multiple strikes and demonstrations).

The first generation of employees to be concerned by this measure will be those born during the period from September 1, 1961 to December 31, 1961. The latter will be able to retire at the age of 62 years and 3 months.

The latest episode in the challenge of this measure is the rejection by the Constitutional Council, on May 3, 2023, of a request by some members of Parliament to consider a popular referendum (the share initiative referendum, called “RIP”) aiming to reinstate retirement at 62.

This recent decision does not signal the end of the opposition to the pension reform, as two bills have since been introduced to prevent retirement at age 64.

The settlement agreement: reminder of the conditions of validity and points of attention

What is a settlement agreement?

A settlement agreement is a contract by which the parties, by mutual concessions, put an end to a dispute or potential dispute between them.

The settlement agreement is most often used to settle a dispute arising from the termination of an employment contract (dismissal, constructed dismissal, challenged resignation, or even termination by mutual agreement). But it can also be concluded to solve an issue arising from the performance of the employment contract.

The settlement agreement prevents the parties from initiating or continuing legal proceedings with the same object.

What a settlement agreement is not?

A settlement agreement is not a way to terminate the employment contract.

What are the conditions of validity of a settlement agreement?

Under French employment law, a settlement agreement is only valid if:

- There is a dispute or potential dispute arising from the performance or the termination of the employment contract.

It is important to note that in the absence of any dispute, it is impossible to settle, insofar as the very purpose of the settlement agreement is to put an end to a dispute. Therefore, the settlement agreement must include the reason of the dispute or possible dispute that the parties want to resolve and specify the respective positions of each party.

- Mutual concessions are made by each party. In practice, they are waivers on both sides of rights, actions, or claims.

The mutual concessions necessarily include a payment from the company, mainly through a settlement indemnity to the employee, on top of his/her legal rights in respect of his/her notice period, severance pay, paid holidays, etc.

- In the case of a settlement agreement whose purpose is to settle a dispute arising from the termination of the contract: it can only be negotiated and concluded after notification of the termination, which must have been made through a registered letter with acknowledgment of receipt.

Points of attention:

- Unemployment insurance

The settlement indemnity may have the effect of imposing on the employee a deferred payment of unemployment benefits.

- Social security and tax treatment

In drafting a settlement agreement, particular attention should be paid to the social security and tax regime of the settlement indemnity paid to the employee.

It is necessary to determine the common intention of the parties in the terms of the transaction in order to decide whether the settlement indemnity has the nature of a remuneration, in which case it is subject to taxes and social security contributions, or whether it is in the nature of damages – and if so, which kind of damages and specific loss (whether financial or psychological). This is a complex issue, due to different approaches from judges and the social security and tax administration, that must be addressed for each settlement agreement.

Our firm remains at your disposal to provide support on these issues.